Relevant Sales Tax History

Links to Important Information

– The Streamlined Sales and Use Tax Agreement and Related Information.

– The Internet Tax Freedom Act (ITFA)

– The Digital Goods and Services Tax Fairness Act of 2019 (not passed)

State Agency Guidance

Note: Links are to external websites.

Arizona – PLR 21-003 – Data on an Electronic Spreadsheet is Tangible Personal Property and H. 2204 on Virtual Currency and NFTs

Arkansas – Candy, Soft Drinks, and Digital Products

California – Graphic Design, Printing, and Publishing (with info on when digital items are taxed)

Colorado – Definition of “tangible personal property” inclusive of digital goods

Connecticut – Sales and Use Taxes on Digital Goods and Canned or Prewritten Software

District of Columbia – Digital Goods Sales Taxability Chart

Florida – Communications Services Tax

Idaho – Idaho Sales & Use Tax Administrative Rules

Illinois – ST-23-0011-GIL – Taxability of Computer Software

Indiana – Application of Sales Tax to the Sale, Lease, or Use of Computer Hardware, Computer Software, and Digital Goods, Advertising Agency Digital Sales Tax Rules

Iowa – Taxation of Specified Digital Products, Software, and Related Services, Notice of Intended Action, Updated Sourcing Rules

Kentucky – Imposition of Sales Tax

Louisiana – Definition of Tangible Personal Property

Maine – Instructional Bulletin No. 56 – Telecommunications

Maryland – Business Tax Tip #29 Sales of Digital Products and Digital Codes

Michigan – Guidance for when sales and use tax applies to sales of software and digital goods, Sales Taxability of Transactions Involving Sale of Computer Software as Service

Minnesota – Computer Software and Digital Products

Mississippi – Notice to purchasers of computer software and/or computer software services

Missouri – Letter Ruling – Digital Copies of Medical Records Sent Electronically are not subject to Sales Tax

Nebraska – Revenue Ruling – Retail Sales of Digital Media

New Jersey – Specified Digital Products & New Jersey Sales Tax and TAM on Convertible Virtual Currency

New Mexico – Digital Advertising Gross Receipts Tax Rule

North Carolina – Certain Digital Property

Ohio – Sales and Use Tax – Digital Products, Data Processing Rules

Pennsylvania – Tax on Digital Products

Tennessee – SUT-65 – Specified Digital Products, Letter Ruling on Bundling

Texas – Guidance on the taxability of electronic games and associated content

Washington – taxation of digital entertainment subscription fees and Interim Statement on NFTs

Wisconsin – General Information on Digital Goods

Related Articles and Resources

(PDF)DdDigital RroDigital DigitRay Langenberg: “Determining the Tax Base”

Young Ran (Christine) Kim & Darien Shanske, State Digital Services Taxes: A Good and Permissible Idea

(Despite What You Might Have Heard), 98 Notre Dame Law Review 741 (2022) (external link)

Tax Foundation Fiscal Fact No. 563, Oct. 2017, “Sales Tax Base Broadening: Right-Sizing a State Sales Tax” (external link).

Agrawal, David R.; Fox, William F. (2020): Taxing Goods and Services in a Digital Era, CESifo Working Paper, No. 8708, Center for Economic Studies and Ifo Institute (CESifo), Munich (external link).

Annette Nellen, “Now Is a Good Time to Start Fixing the Sales Tax Base,” Tax Notes State, September 7, 2020 (posted here with permission from State Tax Notes and Prof. Nellen).

Video from June 1 meeting of Project Workgroup – Research update from MTC Counsel Jonathan White on state treatment of digital products (links to Vimeo); Digital products state research (Excel); Digital products state research (PowerPoint slides); Written summary of research update on state treatment of digital products

Digital Products State Taxation Matrix (PDF) and Matrix Writeup (PDF) – research from Jonathan White

Definitions

Streamlined Sales and Use Tax Agreement (SSUTA) definitions

Streamlined Sales and Use Tax Agreement (SSUTA) –

The current version of the SSUTA and related rules are available on the Streamlined website. These documents define terms that may be relevant. These terms related to both products and transactions. Transaction definitions are discussed in a separate section below. The terms used by SSUTA do not necessarily control what states can tax, or how, but they may impose some limitations and are also used for determining sourcing. This section first summarizes the defined terms and then summarizes how some of these terms are used in the agreement.

- Defined Terms –

SSUTA incorporates some definitions into the specific sections of the agreement (see later subsections here). But most of the definitions are contained in Appendix C. The following summarizes those definitions that are most relevant:

- Tangible Personal Property – SSUTA Appendix C – Part I. Administrative Definitions – contains the agreement’s definition of “tangible personal property.”

“Tangible personal property” means personal property that can be seen, weighed, measured, felt, or touched, or that is in any other manner perceptible to the senses. “Tangible personal property” includes electricity, water, gas, steam, and prewritten computer software.

- Computer Related and Digital Products Definitions – SSUTA Appendix C – Part II. Product Definitions contains the following relevant definitions:

-

- “Computer” means an electronic device that accepts information in digital or similar form and manipulates it for a result based on a sequence of instructions.

- “Computer software” means a set of coded instructions designed to cause a “computer” or automatic data processing equipment to perform a task.

- “Delivered electronically” means delivered to the purchaser by means other than tangible storage media.

- “Electronic” means relating to technology having electrical, digital, magnetic, wireless, optical, electromagnetic, or similar capabilities.

- “Load and leave” means delivery to the purchaser by use of a tangible storage media where the tangible storage media is not physically transferred to the purchaser.

- “Prewritten computer software” means “computer software,” including prewritten upgrades, which is not designed and developed by the author or other creator to the specifications of a specific purchaser. The combining of two or more “prewritten computer software” programs or prewritten portions thereof does not cause the combination to be other than “prewritten computer software.” “Prewritten computer software” includes software designed and developed by the author or other creator to the specifications of a specific purchaser when it is sold to a person other than the specific purchaser. Where a person modifies or enhances “computer software” of which the person is not the author or creator, the person shall be deemed to be the author or creator only of such person’s modifications or enhancements. “Prewritten computer software” or a prewritten portion thereof that is modified or enhanced to any degree, where such modification or enhancement is designed and developed to the specifications of a specific purchaser, remains “prewritten computer software;” provided, however, that where there is a reasonable, separately stated charge or an invoice or other statement of the price given to the purchaser for such modification or enhancement, such modification or enhancement shall not constitute “prewritten computer software.

A member state may exempt “prewritten computer software” “delivered electronically” or by “load and leave.”

-

- “Specified digital products” means electronically transferred:

- “Digital Audio-Visual Works” which means a series of related images which, when shown in succession, impart an impression of motion, together with accompanying sounds, if any,

- “Digital Audio Works” which means works that result from the fixation of a series of musical, spoken, or other sounds, including ringtones, and

- “Digital Books” which means works that are generally recognized in the ordinary and usual sense as “books”.

For purposes of the definition of “digital audio works”, “ringtones” means digitized sound files that are downloaded onto a device and that may be used to alert the customer with respect to a communication.

For purposes of the definitions of “specified digital products”, “transferred electronically” means obtained by the purchaser by means other than tangible storage media.

- SSUTA separately defines telecommunications and a number of related products and services in Section 315: Telecommunication Sourcing Definitions, and these, in turn, may determine sourcing under Section 314. Only one of the terms appears to include digital products:

“M. Prepaid wireless calling service” means a telecommunications service that provides the right to utilize mobile wireless service as well as other non-telecommunications services, including the download of digital products delivered electronically, content and ancillary services, which must be paid for in advance that is sold in predetermined units or dollars of which the number declines with use in a known amount.”

-

- SSUTA Section 332: Specified Digital Products provides limits on the states’ ability to tax “specified digital products.” (See definitions summarized above.) This is a lengthy section with numerous provisions on the extent to which the defined “specified digital products” controls a SSUTA state’s ability to tax. The most relevant provisions are briefly excerpted here:

Use of Defined Terms –

“A. A member state shall not include ‘specified digital products’, ‘digital audio-visual works’, ‘digital audio works’ or ‘digital books’ within its definition of “ancillary services’, ‘computer software’, ‘telecommunication services’ or ‘tangible personal property.’ This restriction shall apply regardless of whether the ‘specified digital product’ is sold to a purchaser who is an end user or with less than the right of permanent use granted by the seller or use which is conditioned upon continued payment from the purchaser. . . .

- SSUTA Section 332: Specified Digital Products provides limits on the states’ ability to tax “specified digital products.” (See definitions summarized above.) This is a lengthy section with numerous provisions on the extent to which the defined “specified digital products” controls a SSUTA state’s ability to tax. The most relevant provisions are briefly excerpted here:

. . .

“C. If a state imposes a sales or use tax on products “transferred electronically” separately from its imposition of tax on “tangible personal property”, that state will not be required to use the terms “specified digital products”, “digital audio visual works”, “digital audio works”, or “digital books”, or enact an additional or separate sales or use tax levy on any “specified digital product.

. . .

“E. Nothing in this section or the definition of “specified digital products” shall limit a state’s right to impose a sales or use tax or exempt from sales or use tax any products or services that are outside the definition of “specified digital products.”

. . .

“G. The tax treatment of a “digital code” shall be the same as the tax treatment of the “specified digital product” or product “transferred electronically” to which the “digital code” relates. . . .

. . .

“I. For purposes of this section, the term “transferred electronically” means obtained by the purchaser by means other than tangible storage media.”

-

-

- SSUTA Section 333: Use of Specified Digital Products (Effective January 1, 2010) also provides the following limit:

“A member state shall not include any product transferred electronically in its definition of “tangible personal property.” “Ancillary services”, “computer software”, and “telecommunication services” shall be excluded from the term “products transferred electronically.” For purposes of this section, the term “transferred electronically” means obtained by the purchaser by means other than tangible storage media.”

- SSUTA Section 333: Use of Specified Digital Products (Effective January 1, 2010) also provides the following limit:

-

Common State Tax Definitions

- Interpretations of “tangible personal property”

- Cases that have interpreted TPP

- Tangible personal property with substantial digital components (cell phones, robots, electric vehicles)

- Goods versus services distinction

- Traditionally – true object or other tests

- As applied to certain digital products

- Examples

- Advertising

- Artificial intelligence

- Data processing services

- Information services

- Software as a Service

- Withdrawn proposed Mississippi definitions:

- Cloud computing is the delivery of computing resources, including software applications, development tools, storage, and servers over the Internet, and includes the software as a service model (SaaS), the platform as a service model (PaaS), the Infrastructure as a Service (IaaS) model, and similar service models.

- SaaS is software hosted and maintained by a third-party provider and delivered to customers over the Internet as a service where the provider maintains the databases and code necessary for the application to run, and the application is run on the provider’s servers.

- PaaS is a cloud computing model where a third-party provider delivers hardware and software tools to users over the internet. The provider hosts the hardware and software on its own infrastructure.

- IaaS is a cloud computing model that delivers fundamental computing, network, and storage resources to consumers on-demand, over the internet.

- Cloud computing is the delivery of computing resources, including software applications, development tools, storage, and servers over the Internet, and includes the software as a service model (SaaS), the platform as a service model (PaaS), the Infrastructure as a Service (IaaS) model, and similar service models.

Common and Emerging Products

This section is based on the results of internet searches by MTC staff about the use of digital technology in particular industries.

-

- Examples of agricultural products – apps, artificial intelligence (such as using artificial intelligence for assessing soil quality, plant yield, and plant deficiencies), augmented and virtual reality (for training and safety), big data (to improve farming operations and reduce food waste), blockchain (for pricing and tracking), cloud computing/storage, computers, data storage, digital advertising, digital controls, digital pasture management, digital seed technology, digital tools/equipment, digital weather forecasting, drones, farm management software, GPS guidance systems, hardware, Internet of Things, machine learning (used to improve crops and identify pests), monitoring technology, networks, precision agriculture, printers – 3D/smart, robotic harvesting, satellites, sensors, smart irrigation, software, software as a service, and variable rate applications (for water, pesticides, and fertilizer).

- Examples of consumer products – Alexa, Astro, Siri, apps, augmented/virtual reality (immersive experiences), ChatGPT, cloud computing/storage, computers, data storage equipment, digital art, digital books/newspapers, digital cameras, digital clothing, digital education, digital images, digital movies, digital music, digital television, digital voice assistants, drones, electric vehicles, e-toys, e-readers, facial recognition products, fitness streaming, fitness wearables, hardware, home automation, home robots, Internet of Things, machine learning, networks, PC peripherals, portable audio, printers – 3D/smart, predictive text, self-driving cars, smart home devices, smart security systems, software, software as a service, smart phones, stable diffusion text-to-image, streaming services, text editors, video games and consoles, virtual reality accessories, wireless communications, and wireless speakers.

- Examples of products in the construction industry – apps, artificial intelligence (used in architecture and engineering), building modelling (3D), cloud computing/storage, computers, connected hardhats, data storage equipment, digital cameras, digital equipment and tools, GPS tracking, humanoid robots, Internet of Things, laser technology, machine learning (to estimate completion time), networks, PC peripherals, printers – 3D/smart, robot swarms for mundane tasks, sensors, software, smart infrastructure, smartphones, software as a service, supply chain management products, virtual construction site visits, virtual reality equipment simulations, and virtual training technology to train workers.

- Examples of educational products – apps, artificial intelligence (used for creating courses, tutoring, and personalized learning), augmented/virtual reality (used for immersive content/experiences and interaction with virtual 3D objects), class response systems, cloud computing/storage, computers, data storage, digital advertising, digital payment, hardware, Internet of Things, machine learning (used for analytics, classroom management, and tracking student performance), online collaboration tools, online courses and webinars, networks, printers – 3D/smart, robots, software, software as a service, virtual classrooms, and virtual field trips.

- Examples of products in the energy industry – apps, artificial intelligence (used for detecting anomalies in generation, consumption, and transmission), augmented/virtual reality (used for training and to see underground infrastructure), blockchain (tracking the generation, distribution, and consumption of renewable energy), cloud computing/storage, computers, controls for fusion magnets, data storage, digital controls, digital payment, digital equipment/tools, hardware, intelligent networking of consumers and generators, Internet of Things, machine learning (determining energy demand), networks, printers – 3D/smart (for parts and prototypes), smart grids, smart meters, smart power consumption tools, robots, software, and software as a service.

- Examples of products in the healthcare industry – apps, artificial intelligence (used for tracking disease spread, interpreting images, and preventative care), augmented and virtual reality (3D views of anatomy), big data, blockchain storage of medical records, chatbot consultations, cloud computing/storage, computers, data storage, digital advertising, digital controls, digital payment, hardware, Internet of Things, machine learning (for diagnostics and imaging), networks, predictive analytics, printers – 3D/smart, robot assisted surgery, software, software as a service, virtual appointments, virtual biopsies, virtual reality headsets for pain, and wearable devices.

- Examples of products in the manufacturing industry – apps, artificial intelligence (assists with failure prediction and maintenance planning and provides 360 degree visibility), augmented/virtual reality (used for training, inventory management, modelling, simulations, and to identify safety hazards), automated production line, big data (used for tracking and analytics), blockchain (used for quality checks and for digital twins of physical assets), cloud computing/storage, cobots (collaborative robots), computers, data storage, digital advertising, digital controls, digital machines, digital payment, digital processing, digital tools, hardware, Internet of Things, machine learning, networks, printers – 3D/smart (to create prototypes and final products), robots, sensors, software, and software as a service.

- Examples of office products – apps, artificial intelligence (assists with research, document tracking, predictive modelling, diagramming transactions, and repetitive tasks in offices such as legal and accounting offices), augmented/virtual reality (for training), computers, cloud computing/storage, data storage, digital advertising, digital images, digital job applications, GPT-3, hardware, Internet of Things, machine learning, networks, printers – 3D/smart, robotic coauthors, software, software as a service, virtual reality onboarding, and videoconferencing.

- Examples of products in the restaurant industry – apps, artificial intelligence (used for supply chain management and to predict inventory and staffing needs), augmented/virtual reality (used for virtual tours, virtual interactive menus, and for training), big data (used for analytics), Bluetooth temperature sensors, blockchain (used for tracking and loyalty programs), cloud storage/computing, cloud-based point of service, computers, data storage, delivery apps, digital advertising, digital inventory tracking, digital kiosks, digital payment, digital table manager, digital tools/equipment, hardware, Internet of Things, machine learning, networks, printers – 3D/smart, purchasing apps, restaurant robots (used for anything from prepping food to serving/delivering food), scheduling software, smart appliances, software, software as a service, tabletop tablets, and virtual onboarding.

- Examples of products in the retail industry – apps, augmented/virtual reality (used for interactive and 3D shopping experiences), artificial intelligence (used to analyze data and send recommendations to customers), big data (used for price optimization and strategic decisions), blockchain (for tracking inventory), chatbots, cloud storage/computing, cloud-based POS, computers, data storage, digital advertising, digital inventory tracking, digital payment, digital twin technology (used to model supply chain), facial recognition, hardware, Internet of Things, machine learning, networks, omnichannel retail, printers – 3D/smart, robots (used to help customers find products, to track inventory, to clean stores, and to manage stores), scheduling software, sensor data, software, software as a service, staff less shops, and virtual onboarding.

- Examples of products in the science industry – apps, artificial intelligence (interpreting results of trials and experiments), augmented/virtual reality (used for visualization), big data, cloud storage/computing, computers, data storage, data analysis, digital controls, digital simulations and modelling, digital tools/instruments, hardware, Internet of Things, machine learning (used for data analysis), networks, printers – 3D/smart, quantum computing, sensor data, software, software as a service, and supercomputers.

- Examples of telecommunication and information technology products – apps, artificial intelligence (used to detect network anomalies), augmented/virtual reality (assists field technicians with repair estimates and troubleshooting), big data (predictive analytics), blockchain (for payments and tracking), chatbots, cloud storage/computing, computers, data centers, data storage, data warehouses, digital controls, digital payment, fiber optic cables, hardware, information services, Internet of Things, machine learning (assists with network optimization), networks, process mining, printers – 3D/smart, quantum computing, robotic automation, satellite technology, server centers, technology related services (support, implementation), software, software as a service, supercomputers, and virtual assistants.

- Examples of products in the travel industry – apps, artificial intelligence (used to evaluate prices and for client assistance), augmented/virtual reality (virtual and guided tours), automatic train control, big data (targeted marketing), blockchain (for payments), chatbots, cloud storage/computing, computers, data storage, digital ads, digital keys, digital gas pumps, digital payment, digital reservations, digital road signs, digital tickets, facial recognition technology, hardware, in-flight entertainment systems, Internet of Things, language translation products, machine learning (to learn more about customers), networks, printers – 3D/smart, robot concierges, satellite technology, software, software as a service, transportation rentals, and virtual assistants.

- Non-Fungible Tokens (“NFTs”) (e.g., PA DOR REV-717, p.12 (05-22) adds NFTs to the list of taxable digital products without definition; WADOR issues “Interim Statement Regarding the Taxability of Non-Fungible Tokens (NFTs) 7/1/22)

- Digital currency

- Data gathered from online activity and sold

Digital Goods and Services Tax Fairness Act (DGSTFA) Definitions

- The DGSTFA is proposed federal legislation that was put forward in the past to provide sourcing limitations on states. See S. 765 (2019). In the legislation, certain terms were defined, including:

- “Digital Code” means a code that conveys only the right to obtain a covered electronic good or service without making further payment.

- “Digital Good” means any software or other good that is delivered or transferred electronically, including sounds, images, data, facts, or combinations thereof, maintained in digital format, where such software or other good is the true object of the transaction, rather than the activity or service performed to create such software or other good, that results in the delivery to the customer of a complete copy of such software or other good, with the right to use permanently or for a specified period, and includes, as an incidental component, charges for the delivery or transfer of such software or other good.

- “Digital service” means any service that is provided electronically, including the provision of remote access to or use of a digital good, and includes, as an incidental component, charges for the electronic provision of the digital service to the customer.

- “Digital service” does not include a service that is predominantly attributable to the direct, contemporaneous expenditure of live human effort, skill, or expertise, a telecommunications service, an ancillary service, Internet access, audio or video programming service, or a hotel intermediary service.

- “Covered electronic good or service” means a digital good, digital service, audio or video programming service of VoIP service.

- “Delivered or transferred electronically” means the delivery or transfer of a digital good by means other than tangible storage media, and the term provided electronically means the provision of a digital service, audio or video programming service, or VoIP service remotely via electronic means.

- “Separate and discrete transaction” means a sale of a covered electronic good or service or digital code sold in a single transaction that does not involve any additional charges or continued payment in order to maintain possession of the digital good or access to or usage of the digital service, audio or video programming service, or VoIP service.

Academic Definitions

- Claudia Loebbecke, Digital Goods: An Economic Perspective (2003), http://www.mm.uni-koeln.de/team-loebbecke-publications-book-chapters/Chapt-024-2002-%20Digital%20Goods%20An%20Economic%20Perspective-scan.pdf

- Digital goods are goods that can be fully expressed in bits so that the complete commercial business cycle can be executed based on an electronic infrastructure such as the Internet.

- To distinguish within the group of digital goods, we use the following criteria: transfer mode, timeliness, usage frequency, usage mode, external effects, and customizability

- When we talk about transfer mode, we distinguish between delivered and interactive goods

- Timeliness covers the constancy and dependence of the value of digital goods over time. (Products like news, weather forecasts, or stock prices normally lose value as time goes by.)

- Usage frequency. Some goods are intended for single use. They lose their customer value after or through use. For instance, the query on a search engine has no recurring value. Other products are designed for multiple uses; examples include software and games.

- When we look at usage mode, we can distinguish between fixed and executable goods. Fixed documents allow handling and manipulation in different ways and by different means than executable goods. With executable goods such as software, suppliers define the form by which the good can be used.

- Products with positive external effects raise the value for customers with increasing numbers of users. For instance, the more participants who agree on a common standard, the more potential partners for exchange exist.

- Customizability reflects the extent to which goods can be customized to specific customer needs. An electronic newspaper has a high degree of customizability in that an average customer is able to design a personal version through combinations of articles. But the articles themselves – being equal for all customers – show low customizability.

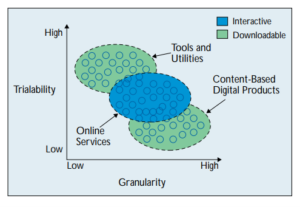

- Kai Lung Hui and Patrick Y.K. Chau, Classifying Digital Products (2003), http://klhui.people.ust.hk/research/2002-CACM.pdf

- “Broadly speaking, digital products refer to any goods or services that can be digitized (converted into a binary format)”

- Classify based on two dimensions: product category and product characteristic

- Product category

- Tools and Utilities (assist users to accomplish specific goals or tasks)

- Content-based Digital Products (newspapers, journals, books, etc.)

- Online services

- Characteristic

- Delivery Mode

- Granularity

- Trialability

- Product category

Federal Definitions

- Internal Revenue Code § 6045(g)(3)(D) provides that “except as otherwise provided by the Secretary, the term ‘digital asset’ means any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar technology as specified by the Secretary.” Pub. L. 117-58, § 80603(c), 135 Stat. 1341 (2021). This definition is effective for returns required to be filed, and statements required to be furnished, after December 31, 2023.

- The IRS website states that digital assets “are broadly defined as any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar technology as specified by the Secretary.” According to the IRS, digital assets include, but are not limited to, convertible virtual currency and cryptocurrency, stablecoins, and non-fungible tokens. https://www.irs.gov/businesses/small-businesses-self-employed/digital-assets. The 2022 draft instructions for Form 1040 use this “digital asserts” definition, and further indicate that “if a particular asset has the characteristics of a digital asset, it will be treated as a digital asset for federal income tax purposes.”

- The White House’s March 9, 2022, Executive Order on Ensuring Responsible Development of Digital Assets provides that the term “digital assets” refers to “all CBDCs [central bank digital currency], regardless of the technology used, and to other representations of value, financial assets and instruments, or claims that are used to make payments or investments, or to transmit or exchange funds or the equivalent thereof, that are issued or represented in digital form through the use of distributed ledger technology. For example, digital assets include cryptocurrencies, stablecoins, and CBDCs. Regardless of the label used, a digital asset may be, among other things, a security, a commodity, a derivative, or other financial product. Digital assets may be exchanged across digital asset trading platforms, including centralized and decentralized finance platforms, or through peer-to-peer technologies.”

- 4356, the Lummis-Gillibrand Responsible Financial Innovation Act (introduced 6/7/2022), provides that “digital asset”

- means a natively electronic asset that—

- confers economic, proprietary, or access rights or powers; and

- is recorded using cryptographically secured distributed ledger technology, or any

- means a natively electronic asset that—

similar analogue; and

- includes—

- virtual currency and ancillary assets in accordance with section 2(c)(2)(F) of the Commodity Exchange Act;

- payment stablecoins in accordance with section 403 of the Commodity Futures Modernization Act of 2000 (7 U.S.C. 27a); and

- any other security or commodity that meets the requirements of subparagraph (A).

Definitions from Other Bodies of Law

Internet Tax Freedom Act (ITFA) Definitions

- Permanent Internet Tax Freedom Act 47 U.S. 151 note

- “Electronic commerce” (Sec. 1105(3)) means any transaction conducted over the Internet or through Internet access, comprising the sale, lease, license, offer, or delivery of property, goods, services, or information, whether or not for consideration, and includes the provision of Internet access.

- “Internet” (Sec. 1105(4)) means collectively the myriad of computer and telecommunications facilities, including equipment and operating software, which comprise the interconnected world-wide network of networks that employ the Transmission Control Protocol/Internet Protocol, or any predecessor or successor protocols to such protocol, to communicate information of all kinds by wire or radio.

A Digital Product Defines Itself

- According to ChatGPT, an open AI platform (openai.com), when asked how to define digital products replied as follows:

- Digital products are products that are delivered and accessed electronically, rather than physically. They can take many different forms, including software, ebooks, music and video files, online courses, and more. Some characteristics of digital products include:

- They are delivered electronically: Digital products are typically delivered to the customer via the internet, often through a download or streaming service.

- They are not physical: Digital products do not have a physical form and are not tangible objects that can be held or touched.

- They can be accessed from any device: Digital products can be accessed from any device with an internet connection, such as a computer, smartphone, or tablet.

- They can be easily copied and shared: Digital products can be easily copied and shared, which can pose challenges for creators and sellers in terms of protecting their intellectual property and generating revenue.

- They can be updated and improved: Digital products can be updated and improved over time, allowing creators to continue to add value to their products and customers to access the latest versions.

- Overall, digital products are a convenient and flexible way for consumers to access and consume a wide range of products and services, and they have become increasingly popular in recent years with the widespread adoption of the internet and digital devices.

- Digital technologies are technologies that use digital information and data for various purposes. Some examples of digital technologies include:

- Computers: Desktop computers, laptops, tablets, and smartphones are all examples of digital technologies that allow users to communicate, create, and access information.

- Internet: The internet is a global network of interconnected computers and servers that allows people to access and share information and communicate with each other.

- Social media: Social media platforms such as Facebook, Twitter, and Instagram are digital technologies that allow users to create and share content, connect with others, and engage in online communities.

- Online storage: Cloud storage services such as Google Drive and Dropbox are digital technologies that allow users to store and access their files and documents online.

- Mobile apps: Mobile apps are software programs that can be downloaded and installed on smartphones and tablets, and they allow users to perform a variety of tasks such as checking their email, ordering food, and tracking their fitness.

- Virtual reality: Virtual reality (VR) technology allows users to experience immersive, computer-generated environments and interact with them in real-time.

- Artificial intelligence: Artificial intelligence (AI) is a branch of computer science that focuses on the development of intelligent systems that can learn, adapt, and make decisions on their own.

- Blockchain: Blockchain is a decentralized, digital ledger that uses cryptographic techniques to record and verify transactions and provide a secure and transparent way to store and transfer data.

- Digital products are products that are delivered and accessed electronically, rather than physically. They can take many different forms, including software, ebooks, music and video files, online courses, and more. Some characteristics of digital products include:

National Conference of Commissioners on Uniform State Laws Definitions

National Conference of Commissioners on Uniform State Laws Revised Uniform Fiduciary Access to Digital Assets Act (2015) – adopted by most states:

-

- Section 2. (10) “Digital asset” means an electronic record in which an individual has a right or interest. The term does not include an underlying asset or liability unless the asset or liability is itself an electronic record.

- Section 2. (11) “Electronic” means relating to technology having electrical, digital, magnetic, wireless, optical, electromagnetic, or similar capabilities.

- Section 2. (22) “Record” means information that is inscribed on a tangible medium or that is stored in an electronic or other medium and is retrievable in perceivable form.

OECD and United Nations Definitions

- Automated digital service” is any service provided on the internet or another electronic network, in either case requiring minimal human involvement from the service provider.

- Specifically includes online advertising services; supply of user data; online search engines; online intermediation platform services; social media platforms; digital content services; online gaming; cloud computing services; and standardized online teaching services.

- “Digital content services” means the automated provision of content through digital means, whether by way of online streaming, accessing or downloading digital content like music, books, videos, texts, games, applications, computer programs, software, online newspapers, and more. OECD “Tax Challenges Arising from Digitalisation – Report on Pillar One Blueprint: Inclusive Framework on BEPS” (2020) Box 2.13.

- “Online advertising services” means online services aimed at placing advertisements on a digital interface and includes services for the purchase, storage, and distribution of advertising messages, and for advertising monitoring and performance measurement. It includes related systems for attracting potential viewers and collecting data from them, including via the provision of access to a digital interface, such as a search engine, social media platform, or a digital content service. This category is meant to be broad and include the direct sale of advertisements and the automated systems and processes for the purchase and sale of advertising. OECD “Tax Challenges Arising from Digitalisation – Report on Pillar One Blueprint: Inclusive Framework on BEPS” (2020) Boxes 2.3 and 2.4.

- ”Digital interface” means any programme or other system allowing access to users to software, content or other information that is accessible by users online, such as websites and mobile applications, regardless of the type of physical support enabling such access. This definition is meant to be broad and would include Internet-connected interfaces embedded in a physical good like the internet of things. OECD “Tax Challenges Arising from Digitalisation – Report on Pillar One Blueprint: Inclusive Framework on BEPS” (2020) Box 2.31.

European VAT Definitions

Links to EU VAT rules:

“Electronically supplied services” include services which are delivered over the Internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention, and impossible to ensure in the absence of information technology.

-

- Non-exhaustive list of examples: (there is further detail to the examples in the documents linked below)

- Supply of digitized products generally, including software and updates to software;

- Services providing or supporting a business or personal presence on an electronic network such as a website or an webpage;

- Services automatically generated from a computer via the Internet or an electronic network, in response to specific data input by the recipient;

- Transfer for consideration of the right to put goods or services up for sale on an Internet site operating as an online market on which potential buyers make their bids by an automated procedure and on which the parties are notified of a sale by electronic mail automatically generated from a computer;

- Internet Service Packages of information in which the telecommunications component forms an ancillary and subordinate part (i.e., packages going beyond mere Internet access and including other elements such as content pages giving access to news, weather or travel reports; website hosting; access to online debates, etc.)

- Non-exhaustive list of examples: (there is further detail to the examples in the documents linked below)

Proposed Definitions from Work Group Participants

Proposed Uniform Definitions for the Tax Base (new version 2025) – Ray Langenberg

Jan 3, 2023 written comments from Charlie Kearns and Jeff Friedman of Eversheds Sutherland, received via email: There is a well-established boundary between digital services that are provided over the Internet versus those services that are commonly referred to as “facilities-based,” such as telecommunications services, where the service provider owns and operates the underlying infrastructure to deliver such services. The distinction between the treatment of these two categories relates to the fact that facilities-based services are typically subject to robust tax treatment and extensive non-tax regulation. This distinction should be acknowledged so that facilities-based services are characterized according to existing laws and not subject to an additional layer of taxation applicable to digital products, including, for example, the SST definitions for products transferred electronically, digital audio-visual works, digital audio works, and other concepts. Some in the business community recommend that these considerations would be furthered by adopting a definition of “digital products” based on the ITFA definition of “electronic commerce,” which states in relevant part “any transaction conducted over the Internet or through Internet access…” However, the business community also notes that such characterization and/or taxability should be analyzed in the context of (i) ITFA’s prohibition on discriminatory taxes on electronic commerce and (ii) overall policy goals of horizontal equity among competing services.

Related Articles and Resources

Article by Natalia Garrett and Grant Nülle, “Digital Goods and Services: How States Define, Tax, and Exempt These Items,” Tax Analysts, Tax Notes State, May 18, 2020.

Slides by Natalia Garrett – Digital Goods: How States Define, Tax and/or Exempt