MTC History

|

TIMELINE OF EVENTS IN THE HISTORY OF THE MTC |

|

The Multistate Tax Commission celebrated its 50th anniversary in 2017. MTC history is entwined with the history of interstate business taxation, especially its constitutional and legislative roots. Throughout 2017, we built this page, creating a timeline of events through weekly “THIS WEEK IN MTC HISTORY” items that appeared on the homepage of our website.

October 1958

Although the MTC was born in 1967, the events that sparked its formation began on October 14, 1958 in the U.S. Supreme Court. On that day, the Court heard argument in the case of Northwestern States Portland Cement Co. v. Minnesota. The question was whether a state could tax business income of companies that did nothing but solicit customers in the state. The Court’s decision, issued in February the following year, would shock some in the business world—holding that solicitation was enough to create nexus. Soon after, Congress stepped in, passing P.L. 86-272 to partially reverse the decision—and began the what became known as the Willis Committee to study state business income taxes with a view toward comprehensive federal preemption. The committee’s activities and recommendations spurred the states into cooperative action to address the compliance burdens on interstate business and led to the eventual formation of the MTC.

Although the MTC was born in 1967, the events that sparked its formation began on October 14, 1958 in the U.S. Supreme Court. On that day, the Court heard argument in the case of Northwestern States Portland Cement Co. v. Minnesota. The question was whether a state could tax business income of companies that did nothing but solicit customers in the state. The Court’s decision, issued in February the following year, would shock some in the business world—holding that solicitation was enough to create nexus. Soon after, Congress stepped in, passing P.L. 86-272 to partially reverse the decision—and began the what became known as the Willis Committee to study state business income taxes with a view toward comprehensive federal preemption. The committee’s activities and recommendations spurred the states into cooperative action to address the compliance burdens on interstate business and led to the eventual formation of the MTC.

January 1966

On January 13 and 14, 1966, the National Association of Tax Administrators (FTA’s original name) held an unprecedented special meeting in Chicago to discuss and adopt a resolution opposing H.R. 11798, the Interstate Taxation Act. You know it as the famous Willis bill. The resolution called the Willis bill “an unwarranted, unnecessary, and undesirable intrusion into the tax and fiscal jurisdiction of the states . . . [that] would be destructive of the principles of federalism enunciated by our founding fathers.” NATA offered workable alternatives to eliminate the need for such extreme federal preemption. This was the first meeting where the idea of a multistate compact was envisioned.

November 1966

A committee of attorneys general and tax administrators under the auspices of the Council of State Governments held a final drafting session for the Multistate Tax Compact in November 1966.

April 1967

On April 20, 1967, Kansas became the first state to enact the Multistate Tax Compact into its state tax laws. The Compact was drafted in 1966 by a widely representative group of state officials, including tax administrators, attorneys general, state legislators, and a special committee of the Council of State Governments, its primary purpose is to promote uniformity in tax administration procedures among the states.

June 1967

On June 8, 1967, the state of Washington became the second state to enact the Multistate Tax Compact. The countdown to the Compact’s legal effectiveness was now in full swing. The Compact required seven states to enact it before it became operational.

On June 8, 1967, the state of Washington became the second state to enact the Multistate Tax Compact. The countdown to the Compact’s legal effectiveness was now in full swing. The Compact required seven states to enact it before it became operational.

On June 13, 1967, the state of Texas became the third state to enact the Multistate Tax Compact.

On June 13, 1967, the state of Texas became the third state to enact the Multistate Tax Compact.

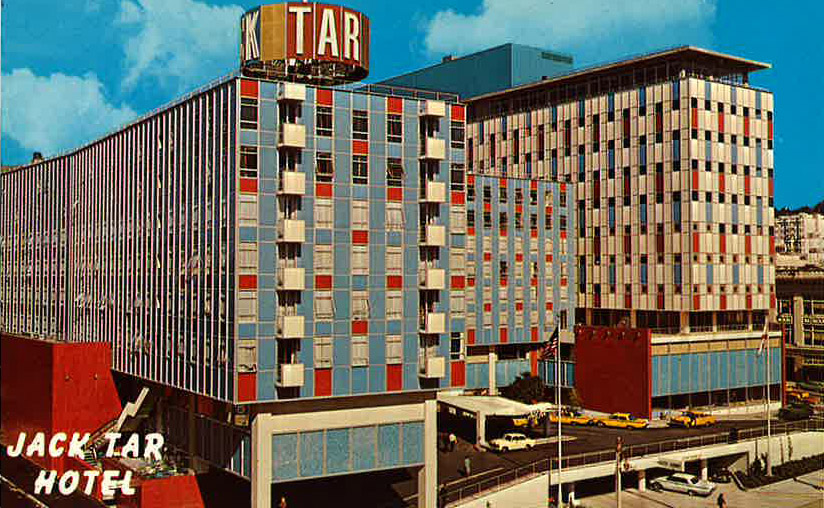

On June 15, 1967, the first organizational meeting of the MTC was held at the Jack Tar Hotel in San Francisco (immediately following NATA’s annual meeting that year). Senator Charles Welch, Jr., of Utah, chair of the governing board of the Council of State Governments, convened the meeting and presided until the election of MTC officers and executive committee. Representatives of eleven states whose legislatures had passed the Multistate Tax Compact participated in the meeting, along with some other interested states. But within a few days of the meeting, participants realized that an insufficient number of governors had actually signed their states compact legislation, so the Compact was not yet effective. A second organization meeting would be held later that year.

On June 15, 1967, the first organizational meeting of the MTC was held at the Jack Tar Hotel in San Francisco (immediately following NATA’s annual meeting that year). Senator Charles Welch, Jr., of Utah, chair of the governing board of the Council of State Governments, convened the meeting and presided until the election of MTC officers and executive committee. Representatives of eleven states whose legislatures had passed the Multistate Tax Compact participated in the meeting, along with some other interested states. But within a few days of the meeting, participants realized that an insufficient number of governors had actually signed their states compact legislation, so the Compact was not yet effective. A second organization meeting would be held later that year.

On June 19, 1967, the state of New Mexico became the fourth state to enact the Multistate Tax Compact.

On June 19, 1967, the state of New Mexico became the fourth state to enact the Multistate Tax Compact.

July 1967

Illinois became the fifth Multistate Tax Compact state on July 1, 1967. While it was already clear by June that enough states had passed the Multistate Tax Compact and—through letters from several governors—that it would get signed into law, it took time for the paperwork to be processed and prepared for signature. So the Compact was not yet effective, and it would be more than a month before the governors in the two additional needed states would sign the legislation.

Illinois became the fifth Multistate Tax Compact state on July 1, 1967. While it was already clear by June that enough states had passed the Multistate Tax Compact and—through letters from several governors—that it would get signed into law, it took time for the paperwork to be processed and prepared for signature. So the Compact was not yet effective, and it would be more than a month before the governors in the two additional needed states would sign the legislation.

August 1967

On August 4, 1967, the Multistate Tax Compact became effective in Florida and Nevada when it was signed into law by their respective governors. That brought the total number of enacting states to the minimum seven required by the Compact, and the Multistate Tax Commission was finally, truly born.

September 1967

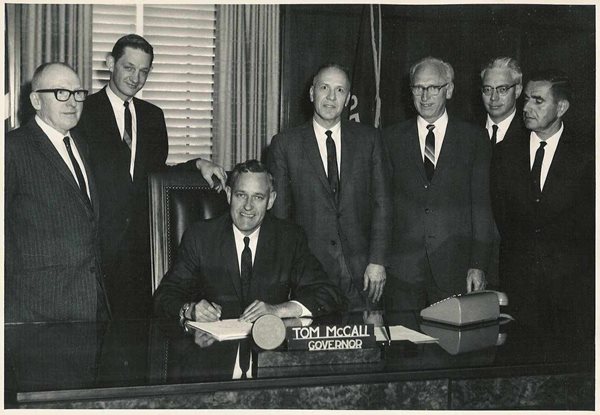

On September 13, 1967, Oregon becomes the eighth state to join the Multistate Tax Compact.

On September 13, 1967, Oregon becomes the eighth state to join the Multistate Tax Compact.

October 1967

The first truly official meeting of the Multistate Tax Commission was held at Gramercy Inn in Washington, D.C., Oct. 16 – 17, 1967. An organizational meeting on June 15 pre-dated the effective date of the Compact by seven weeks. After hearing a report about which states had passed the Multistate Tax Compact and a roll call of the members and alternates from those states, the Commission unanimously confirmed the previous actions and authority of the MTC chair, George Kinnear. Kinnear was Chairman of the Washington State Tax Commission and had been elected MTC chair at the June meeting. The MTC was finally, formally underway.

The first truly official meeting of the Multistate Tax Commission was held at Gramercy Inn in Washington, D.C., Oct. 16 – 17, 1967. An organizational meeting on June 15 pre-dated the effective date of the Compact by seven weeks. After hearing a report about which states had passed the Multistate Tax Compact and a roll call of the members and alternates from those states, the Commission unanimously confirmed the previous actions and authority of the MTC chair, George Kinnear. Kinnear was Chairman of the Washington State Tax Commission and had been elected MTC chair at the June meeting. The MTC was finally, formally underway.

Missouri becomes the ninth state to join the Multistate Tax Compact on October 13, 1967, followed shortly by the tenth state, Nebraska, on October 23, 1967.

Missouri becomes the ninth state to join the Multistate Tax Compact on October 13, 1967, followed shortly by the tenth state, Nebraska, on October 23, 1967.

January 1968

On January 1, 1968, Arkansas became the 11th state to join the MTC when the Multistate Tax Compact went into effect there.

April 1968

Idaho becomes the 12th state to enact the Multistate Tax Compact on April 10, 1968.

May 1968

Hawaii enacted the Multistate Tax Compact effective May 7, 1968, becoming the 13th member of the Commission.

November 1968

On November 19, 1968, the Commission held its fourth official meeting at the Missouri State Office Building in Kansas City. Commission Chair George Kinnear discussed the progress of state membership in the MTC during his report. He noted that there would need to be at least 30 compact members and 10 associate members by the end of 1969 to meet the projected membership schedule. It was an ambitious schedule that would not be met: The most states that had adopted the Compact at any one time was 21, first achieved in 1972. Currently, 15 states and D.C. are compact members, but every state but two are engaged at some level with the Commission either through one of its formal programs or through participation in its many committees and workgroups.

February 1969

On February 1, 1969, Eugene F. Corrigan started his new job as the first executive director of the new Multistate Tax Commission. Gene had been the chief legal officer for the Chicago office of the Illinois Department of Revenue. Before that he filled a variety of senior legal and tax positions with the Illinois Department of Revenue and he had been with Sears Roebuck. Corrigan was the chairman of a Commission sales tax committee from the start of the Commission. He would serve 16 years as executive director, cementing his legacy as a key player in the Commission’s formative years. He stayed on the staff as executive counsel until 1989, leaving to join Ernst & Young’s Sacramento office as a state tax consultant. He retired in 1999.

May 1969

Utah became the 16th member by enacting the Compact on May 13, 1969.

—————

In May 1969, MTC’s first chair, George Kinnear, teamed with Leonard Kust, vice president and counsel for Westinghouse Electric Corporation, to create a so-called “Ad Hoc Committee” to target a problem with Congress. Kinnear and Kust both were concerned about the interstate taxation bills in Congress. They were concerned that mere opposition by the states to the bills would not be sufficient. So they formed an unofficial Ad Hoc Committee with representatives of both states and business. While this was not an MTC committee, it had several MTC leaders among its membership. Members met several times before releasing a proposal on multistate taxation in mid-1970. Their compromise position, crafted from multiple opposed positions, was controversial within the business community and among the states. An unprecedented three-day special Commission meeting was scheduled in July 1970 for the proposal to be deliberated.

October 1969

On October 28, 1969, the Commission voted by secret ballot to choose among the three cities recommended by the Site Committee: Chicago, Denver or Kansas City. Denver won handily and the MTC resolved to take immediate steps to remove the site of the office of the Commission to Denver as soon as possible but not later than the end of that year. Executive Director Gene Corrigan, who had started in February, was living in Chicago at the time and did not want to move, so he tendered his resignation. He reconsidered this decision and, with the support of his family, relocated to Colorado, where MTC remained until the ultimate move to Washington, D.C.

July 1970

In 1970, the MTC held a “first of its kind” special three-day day meeting July 27–29 in Denver to consider a proposal that had been put together by the so-called Ad Hoc Committee, which was composed of representatives of both states and business. This unofficial group had worked for a year to develop a compromise proposal between businesses and states to be proffered as the basis for federal legislation. The compromise proposal was specifically rejected at the meeting. The primary objections related to sections on combined reporting and the resolutions of disputes. But the work of the Ad Hoc Committee was not unappreciated and many significant provisions became the building blocks for later proposals.

October 1970

In October 1970, an audit coordinator was added to the Commission staff to develop the Joint Audit Program. The program contemplated the performing of audits with, or on behalf of, several states at the same time so that one examination of a corporation’s books and records would suffice for the audit purposes of the several participating states. Two audit offices had been established by the following spring, and the program quickly drew the ire of the business community, leading ultimately to the U.S. Steel litigation.

January 1971

Member states began to develop the MTC audit program early in 1971. The vision: help states that lack the resources to perform complicated corporate income tax audits. The program included auditor training and a structure for agencies to share information and collaborate on difficult enforcement issues. Taxpayers pushed back with determined resistance that blossomed into litigation. They argued states did not have the constitutional authority to enter into a compact that provided for a joint audit program.

December 1971

The agenda for the Executive Committee meeting on December 8, 1971, contained this unusual item: “CONSIDERATIONS REGARDING TREATMENT OF C.O.S.T.” COST (then Committee, now Council, on State Taxation) was formed by the State Chambers of Commerce in large part as a response to the formation of the Multistate Tax Commission. The relationship between COST and the MTC was initially adversarial, with COST supporting the businesses that were litigating to have the Compact declared unconstitutional. While COST and MTC are still divided over important state tax policy issues, over the years the two organizations have attempted to find common ground, especially when the issues involve reducing the costs of administering and complying with state taxes.

The agenda for the Executive Committee meeting on December 8, 1971, contained this unusual item: “CONSIDERATIONS REGARDING TREATMENT OF C.O.S.T.” COST (then Committee, now Council, on State Taxation) was formed by the State Chambers of Commerce in large part as a response to the formation of the Multistate Tax Commission. The relationship between COST and the MTC was initially adversarial, with COST supporting the businesses that were litigating to have the Compact declared unconstitutional. While COST and MTC are still divided over important state tax policy issues, over the years the two organizations have attempted to find common ground, especially when the issues involve reducing the costs of administering and complying with state taxes.

April 1972

In 1972, the MTC held a Corporate Income Tax Audit Workshop Seminar April 24 – 27 in Boulder, Colo. The seminar was “the first of its kind ever to be held,” according to the Multistate Tax Newsletter of April 1972, and response exceeded expectations. The MTC planned other courses in the various phases of tax administration, all of which would focus on practical aspects. The Commission has been conducting training ever since. Current courses include legal, sampling, audit and technology plus other topics that enhance the knowledge and practical skills of state and local government personnel.

December 1972

On December 1, 1972, the Multistate Tax Commission unanimously ratified Florida’s continued status as a party to the Compact even though Florida had repealed Articles III and IV. The Commission declared that Florida was “adhering to the spirit of the Compact” and resolved that “Florida be recognized as a member in good standing of the Multistate Tax Compact and the Multistate Tax Commission.” Since then, the majority of the other compact member states have made similar changes so as to put additional weight on the sales factor of the apportionment formula. The authority of the states to do so would eventually be challenged by taxpayers arguing that the states were not free to alter the Compact in this way. To date, the states have prevailed in those challenges.

February 1973

During its formative years, the MTC benefited by a number of individuals touting the Multistate Tax Compact and advocating for more states to enact it. Commission officers and others wrote letters, op-eds and articles to increase awareness and extol the benefits of joining the MTC. One example comes from February 1973, written by none other than North Dakota State Tax Commissioner Byron L. Dorgan, then chair of the Commission and later a U.S. senator. Dorgan was one of the Commission’s staunchest proponents. The article, published in the Iowa edition of Business and Industry magazine, was entitled “Uniformity Push Needs Iowa.” While Iowa never did enact the Compact, it was an active associate member state and participates in the Joint Audit and National Nexus Programs.

April 1975

On April 14, 1975, an event occurred that proved to be a turning point in the MTC’s U.S. Steel litigation. Brought by dozens of multistate corporations in courts around the country, that litigation was eventually consolidated in New York’s southern district. The plaintiffs sought a ruling that the Commission’s joint audit program was unconstitutional. The litigation not only emboldened corporations selected for joint audit routinely to routinely refuse to provide records, it nearly bankrupted the Commission. Up to that point, the Commission was represented by the legendary Jerome Hellerstein. He had resisted calls to move for summary judgment, insisting instead that the Commission must comply with all the plaintiffs’ burdensome discovery requests — in part out of concern for public appearance. On April 14, 1975, the Commission opted to part ways with counsel, and instead, hired William D. Dexter to represent the Commission. He promptly filed a summary judgment motion, which was granted by the court in 1976 over the plaintiffs’ strenuous objections.

May 1975

On May 1, 1975, the Commission hired its first general counsel, William Dexter. Dexter’s hiring was necessitated by the U.S. Steel litigation, which was threatening the MTC’s very existence. Dexter not only achieved renown for winning that case (and beating Erwin Griswold, former dean of the Harvard Law School). He was a noticeably unique character. Dexter was physically striking, tall, thin and with a shock of white hair. Long-time MTC executive director Gene Corrigan called him “truly one of a kind,” “brilliant,” “whimsical,” “a zealot,” “fearless,” and “a preacher.” In 1983, Dexter retired from the MTC to attend the seminary. But within a month he had so disrupted the place that the faculty asked him to leave. Dexter returned to the MTC. He soon met an ex-nun, however, and after a few dates, she agreed to marry him. The two then sailed away — literally, on his sailboat, and figuratively, in his RV — and lived happily ever after until his death in 1998.

June 1975

At the MTC’s general session in Colorado on June 2, 1975, Colorado Gov. Lamm presented welcoming remarks that included: “I have found, not only in my short time as governor but also during eight years in the legislature, that it is often the most important groups that are, like you, relatively unsung and unheralded in carrying on silently the very good work that you have done.”

January 1976

The Washington Supreme Court ruled in 1976 that the Multistate Tax Compact did not violate the U.S. Constitution in any way. This was the first definitive win for the Commission in litigation that would eventually involve 16 of the largest corporations in the country, litigating in multiple state and federal courts. The Washington case had been brought by the Commission as a declaratory judgment action when taxpayers that were selected for joint audit on behalf of Washington and other states declined to cooperate with those audits. While this victory did not mark the end of that litigation — not by any means — the Commission had taken an important step in hiring its first general counsel, William Dexter, who not only prevailed in this case but would also prove his mettle in future litigation. He is also informally known as “the most colorful of all the MTC’s general counsels.”

June 1977

In June 1977, the Executive Committee interviewed and extended a job offer to Jonathan Rowe to become the MTC’s D.C.-based deputy director. Jon Rowe graduated from law school in 1971, but he never took a bar exam and never practiced law. Instead, he moved to Washington, D.C., and became one of Ralph Nader’s first “raiders.” He developed an interest in tax policy, and served on Nader’s Tax Reform Research Group. After serving as the MTC’s deputy director for a couple of years, where his focus was federal legislative activity, he became the associate director of Citizens for Tax Justice, and later joined the staff of then Senator Byron Dorgan. He left Byron’s staff to become a journalist, wrote and edited for a number of publications, and was admired for his concise prose. He gained notoriety for his writings on economics and being an advocate of the notion of community commons. In 2002, he started and hosted a weekly radio show. He passed away in 2011.

September 1977

On September 15, 1977, the Commission’s Executive Committee considered whether or not the MTC should file an amicus brief at the request of the taxpayer in the appeal of Moorman Mfg. Co. v. Bair from the Iowa Supreme Court to the U.S. Supreme Court. Some members of the committee “considered it important to encourage the U. S. Supreme Court’s hearing of the case and that the MTC be consistent in seeking uniformity among state taxing statutes and, particularly, to oppose the drastically inequitable results which the single factor formula produces when only one state is using that formula.” The Commission’s executive director was concerned about directly opposing a state in litigation. The committee voted to file a brief encouraging the court to grant certiorari without getting into the merits of the case — the MTC’s argument was one paragraph long simply encouraging the Supreme Court to hear the case. The Supreme Court did decide to hear the case, and ultimately, the MTC filed an amicus brief on the merits in support of neither party, but encouraging the court, if it struck down the single-factor formula, to adopt UDITPA as the constitutional standard to resolve multiple or discriminatory tax burden questions under the commerce clause.

On September 15, 1977, the Commission’s Executive Committee considered whether or not the MTC should file an amicus brief at the request of the taxpayer in the appeal of Moorman Mfg. Co. v. Bair from the Iowa Supreme Court to the U.S. Supreme Court. Some members of the committee “considered it important to encourage the U. S. Supreme Court’s hearing of the case and that the MTC be consistent in seeking uniformity among state taxing statutes and, particularly, to oppose the drastically inequitable results which the single factor formula produces when only one state is using that formula.” The Commission’s executive director was concerned about directly opposing a state in litigation. The committee voted to file a brief encouraging the court to grant certiorari without getting into the merits of the case — the MTC’s argument was one paragraph long simply encouraging the Supreme Court to hear the case. The Supreme Court did decide to hear the case, and ultimately, the MTC filed an amicus brief on the merits in support of neither party, but encouraging the court, if it struck down the single-factor formula, to adopt UDITPA as the constitutional standard to resolve multiple or discriminatory tax burden questions under the commerce clause.

February 1978

On February 21, 1978, the U.S. Supreme Court upheld the validity of the Multistate Tax Compact as a voluntary association among the states in the United States Steel Corp. v. Multistate Tax Commission case. The decision was the culmination of a multi-year effort by large, interstate corporations and the Committee On State Taxation (COST) to destroy the nascent MTC. In the face of the MTC’s efforts to conduct joint, multistate audits, large companies had challenged the constitutionality of the Compact on four grounds. Their claims: (1) the Compact, never having received the consent of Congress, is invalid under the Compact Clause; (2) it unreasonably burdens interstate commerce; (3) it violates the rights of multistate taxpayers under the Fourteenth Amendment; and (4) its audit provisions violate the Fourth and Fourteenth Amendments. But the U.S. Supreme Court rejected all of these claims, vindicating the MTC as intergovernmental state tax agency in general, and its multistate joint audit program in particular.

March 1979

At a March 16 Executive Committee meeting in 1979, members considered a memo from MTC Audit Manager Storm Allman reporting that he had been examining the potential of “some form of data collection device (mechanical) to be used in connection with a data processing application” that he hoped would improve the efficiency of sales and use tax audits. This early discussion highlights the ongoing effort to make the MTC joint audit program more efficient through the use of technology.

March 1980

On March 19, 1980, the U.S. Supreme Court decided Mobil Oil v. Commissioner of Taxes of Vermont. The seminal ruling established that a state other than a corporation’s legal or commercial domicile may constitutionally tax dividends from subsidiaries operating abroad. The decision is famous for its referral to the unitary business principle as the “linchpin” of apportionability. The case attracted luminaries. Jerome Hellerstein argued for the taxpayer. But he was no match for Vermont and the MTC’s first general counsel, William Dexter, who not only filed the Commission’s amicus brief in the case, but also participated in the oral argument, where he clarified the role of intangibles in the apportionment. You can read or listen to his argument at https://www.oyez.org/cases/1979/78-1201.

July 1981

In Kansas City on July 16, 1981, the Commission adopted bylaw changes that officially moved the annual business meeting to the month of July. The bylaws in the first 14 years of MTC’s history had required a meeting before the start of the MTC fiscal year, July 1. The Commission’s annual meeting has been held in ever since in the latter half of July (with an occasional foray into very early August).

November 1981  In November 1981, the Commission launched the Multistate Tax Commission Review, a journal on “state taxation of multijurisdictional commerce.” It was a complimentary publication usually issued a couple of times each year, and featured submitted articles on topics of interest. The last print edition—Vol. XXII, No. 2—was published in the spring of 2011. A digital-only version was published once in the winter of 2013; much of the content that would make up an edition of the Review is now published as it becomes available on the MTC website.

In November 1981, the Commission launched the Multistate Tax Commission Review, a journal on “state taxation of multijurisdictional commerce.” It was a complimentary publication usually issued a couple of times each year, and featured submitted articles on topics of interest. The last print edition—Vol. XXII, No. 2—was published in the spring of 2011. A digital-only version was published once in the winter of 2013; much of the content that would make up an edition of the Review is now published as it becomes available on the MTC website.

Past volumes are available online.

May 1982

The notion of locating the main office of the MTC in Washington, D.C. popped up during an Executive Committee meeting May 17 – 18, 1982. At the time, the Commission was located in Boulder, Colo. Committee members felt the MTC was spending enough time and attention to affairs in the nation’s capital to warrant a permanent office there. But it was six more years before members overcame their concerns and tasked the then-new executive director Dan Bucks with moving the office. Since 1988, the MTC’s headquarters has been on North Capitol Street, a stone’s throw from the edge of the Congressional grounds, and conveniently located in the same building with the FTA, the National Governors Association and other groups and coalitions that interact regularly with the Commission.

July 1985

On July 8, 1985, the U.S. Treasury Department came out with draft legislation that would have addressed the states’ concerns about multinational tax reporting identified during deliberations of the Reagan Administration’s Worldwide Unitary Taxation Working Group. This group was formed after California’s imposition of worldwide-combined filing was upheld in the Container case, and the group sought to pressure states into rolling back worldwide filing. Gene Corrigan, Executive Director of the MTC, and Leon Rothenberg, Executive Secretary of the NATA (now the FTA), represented state tax administrators as part of the group. They mounted strong objections to the federal government’s attempts to interfere with the use of formulary apportionment to tax multinationals—providing evidence that the federal government’s approach to transfer pricing allowed companies to shift income overseas. As a compromise, Treasury promised to implement corporate reporting requirements so that the sourcing of their worldwide income could at least be tracked. The legislation was never adopted. Now, three decades later, the OECD has proposed international requirements to address the same problems.

September 1987

Nebraska became the first non-Compact state to participate in the Commission’s Joint Audit Program when they signed a contract to participate on September 18, 1987. The “Agreement of Conditional Grant and Contract for Auditing Services” was described as “experimental,” but the MTC had determined that its efforts to achieve the purposes of the Compact would be “furthered through its auditing program; and that its effectiveness in achieving its purposes will be increased upon its performing audits for as many states at one time as practicable, including states that are not parties to the Compact.” The experiment was a success—Nebraska has been a participant ever since, and more than a dozen other non-Compact states have joined the program over the years as well.

Nebraska became the first non-Compact state to participate in the Commission’s Joint Audit Program when they signed a contract to participate on September 18, 1987. The “Agreement of Conditional Grant and Contract for Auditing Services” was described as “experimental,” but the MTC had determined that its efforts to achieve the purposes of the Compact would be “furthered through its auditing program; and that its effectiveness in achieving its purposes will be increased upon its performing audits for as many states at one time as practicable, including states that are not parties to the Compact.” The experiment was a success—Nebraska has been a participant ever since, and more than a dozen other non-Compact states have joined the program over the years as well.

February 1988

On February 29, 1988, Dan Bucks began a nearly 17-year stint as executive director of the Multistate Tax Commission. Dan is the longest-serving executive director in MTC history. Dan came to the Commission after serving about 6-1/2 years as the deputy director of the Montana Department of Revenue. Within his first year, he had relocated the head office of the MTC from Boulder, Colo., to Washington, D.C., and reinvigorated state participation in the MTC. Dan quickly became the face of the Commission, and was widely recognized as a fervent supporter of state cooperation and defender of the balance of state and federal power inherent in American federalism. Dan left the Commission’s staff at the end of 2004 to accept his appointment at the director of the Montana Department of Revenue, but remained very active in the MTC. He retired in January 2013, but is still doing some work as a consultant and expert on public revenue policy and administration, and works as a columnist for State Tax Notes.

April 1989

Paull Mines joined the Commission’s legal staff on April 1, 1989. He went on to become general counsel, a position he held for eight years until he lost his battle with cancer in 2002. Paull was the author of numerous articles and wrote or co-wrote 16 MTC amicus briefs, all but three of which were for the U.S. Supreme Court. He was known for his grace, humility, humor, curiosity and intellect. Paull’s egalitarian spirit toward people, and his encyclopedic knowledge of taxation, informed his commitment to tax fairness and taxpayer rights. His self-described professional passion was “preserving our federalism” by developing state tax systems that are understandable, administrable and fair for taxpayers and states alike. The MTC established the Paull Mines Award for Contributions to State Tax Jurisprudence in 2007 to recognize state tax attorneys who exemplify Paull’s leadership, legal excellence, professional integrity and commitment to shared knowledge.

September 1989

On September 29, 1989, MTC held the first organizational meeting of the Nexus Advisory Committee in Rapid City, S.D. It was charged with preparing recommendations to the states on the “desirability, nature, and financing” of a National Nexus Program. The hallmarks of the resulting plan are still found in the Commission’s current program: (1) a multi-state voluntary disclosure program, in which nonfilers may, through a confidential and substantially uniform process, and single point of contact, limit back-tax and penalty liability; (2) an information exchange among program states; and (3) the MTC Nexus School, a training course for state personnel on the basics of nexus law and techniques of discovery and nexus audit.

March 1990

In 1990, the Commission mailed letters to the states requesting their formal commitment to the implementation of a mail order sales and use tax collection agreement between the MTC and the Direct Marketing Association. This effort was one of several initiatives to deal with mail order sales challenges (now remote commerce challenges) facing states after the National Bellas Hess decision and later the Quill decision. Although states often felt they were close to reaching resolution with remote sellers, a comprehensive solution was elusive. The failure to achieve an agreement eventually led to creation of the Streamlined Sales Tax Project.

September 1991

In 1991, the push was on by the MTC and other state organizations to get the U.S. Supreme Court to grant the petition of catalog seller Quill urging review of the decision by the North Dakota supreme court. The MTC, along with the National Governors Association, the National Conference of State Legislatures and others, was asking the Supreme Court to grant the taxpayer’s petition to review a decision in which the state had been victorious. According to their joint amicus brief filed September 4, 1991, the Supreme Court’s decision in National Bellas Hess “casts a shadow of uncertainty over current use tax collection efforts.” The brief noted that there had been, at that time, a series of legislative moves to impose collection obligations on remote catalog sellers by statute, and that, with the exception of Tennessee and North Dakota, the state courts had ruled those statutes unconstitutional. The North Dakota case was the first case upholding the state statute to arrive at the Supreme Court. That same week, the state of Pennsylvania, which had lost its Bellas Hess challenge in state court, filed a petition for review of that decision, Bloomingdale’s by Mail, where its court ruled the remote seller statute to be unconstitutional. Pennsylvania’s petition was ultimately denied, while Quill’s, of course, was granted.

February 1992

The MTC has a long history of supporting states though the filing of amicus curiae briefs. The MTC has filed in most of the significant state tax cases to come before the U.S. Supreme Court in the last 45 years. For example, it was February 1992 when the Commission filed a brief in support of New Jersey in Allied-Signal Inc. v. Director, Division of Taxation. Allied-Signal examined whether an asset could be part of a taxpayer’s unitary business even if there was no unitary relationship between the taxpayer and the asset. The Supreme Court said it could if the asset served an operational function rather than an investment function in the taxpayer’s business. However, the court found that New Jersey could not impose a tax because there was no unitary relationship, and the asset did not serve an operational function. You can find this brief, and others filed by the MTC, at the Amicus Briefs web page.

February 1993

In what is the most unusual manner by which a state becomes a party to the Multistate Tax Compact, Alabama is officially recognized as party state to the Compact—effective since 1977—when Alabama’s Court of Civil Appeals decides in favor of the taxpayer in Dep’t of Revenue v. MGH Management, Inc., 627 So.2d 408 (Ala. Civ. App. 1993). The court ruled that Alabama effectively ennacted the Compact in 1977 through the state’s recodification of the Code of Alabama 1975. Alabama had contingently enacted the Compact in 1966 subject to the “passage and approval by the Congress of an act authorizing the various states to enter into such Multistate Tax Compact.” In the recodification process, this language had been eliminated, but the implications were unknown and unacted upon by either Alabama or the MTC until taxpayers won the 1993 case.

December 1995

In December 1995, 26 states signed onto the MTC’s Nexus Program Bulletin 95-1. The bulletin set out the states’ position that a computer manufacturer’s use of third-party warranty service providers, a common practice within the industry, established sales and use tax nexus for those manufacturers, who were beginning to sell directly to consumers. That position proved controversial, especially for California. Within weeks, the computer industry there mobilized, attempting to persuade state administrators and lawmakers not only to pull the state’s support for the bulletin, but also to pull out of the MTC entirely. Ultimately, California administrators withdrew support for the bulletin, though state lawmakers rejected calls to abandon the state’s membership in the MTC. Those defending the bulletin reasoned that it was better for states to “telegraph” their position before undertaking audits and litigation, so that taxpayers could chose to comply voluntarily. And some did. But eventually, litigation on the issue commenced. State courts were split. In a case out of New Mexico, won by the state, the taxpayer (Dell) petitioned the U.S. Supreme Court to consider the issue, but the court declined, as it has declined every state tax nexus case since Quill.

November 1996

A special Commission meeting was held on November 21, 1996, for consideration of a “Public Participation Policy.” Adopting a formal policy on public participation and access to all Commission meetings was important to address concerns that states might be violating their own open meetings laws when participating in MTC meetings. The policy is patterned after the wording and structure of California’s “Bagley-Keene Act” open meeting law and was adopted unanimously. The current version can be found online.

August 1998

The MTC usually opposes federal legislation on state tax matters. But on Aug. 7, 1998, the Commission adopted two resolutions that praised and encouraged Congress. Resolution 98-3, thanked Congress and the President for enacting H.R. 2676 authorizing reciprocal refund offsets. Resolution 98-2, Taxation of Mobile Telecommunications Services, commended the telecommunications industry for initiating a proposed Mobile Telecommunications Sourcing Act and endorsed the concept of a federal solution to the mobile telecommunications sourcing issue, albeit with several conditions. After a cooperative development period among the states and industry, the Mobile Telecommunications Sourcing Act was signed into law on July 28, 2000.

July 2004

During a teleconference on July 12, 2004, the Executive Committee discussed a recommendation by a special working group that UDITPA be updated. The committee discussed what the initial steps would be, and Dan Bucks, executive director at the time, suggested that the Committee consider whether or not to embark on the project in conjunction with National Conference of Commissioners on Uniform State Laws (NCCUSL, now the Uniform Law Commission), the original authors of UDITPA. Bruce Johnson, then Commission Chair, requested that MTC staff begin looking at what issues should be addressed in a update. But it would be two years before the MTC made its initial overture to NCCUSL highlighting five areas of UDITPA in critical need of an update, and asking NCCUSL to do it.

August 2005

In August 2005, professors W. Bartley Hildreth, Matthew N. Murray, and David L. Sjoquist published Fiscal Research Center Report No. 110, Cooperation or Competition: The Multistate Tax Commission and State Corporate Tax Uniformity. Their paper first considers why the MTC was formed and what it is and does, then focuses on the issue of tax uniformity, discussing MTC’s role in achieving interstate tax uniformity of state corporate income tax systems. While noting that “the cost of non-conformity for elected officials and corporate taxpayers, in particular, and the economy, in general, remains unanswered,” they did credit member states united by the Compact because “the MTC has faithfully pushed the need for uniformity and cooperation against the competitive nature of states and the forceful challenge of corporate taxpayers.” Their report—an invaluable reference on the nature of the MTC and its challenges—is available online.

August 2013

On August 20, 2013, the Tenth Circuit Court of Appeals ruled that it lacked jurisdiction under the Tax Injunction Act to hear DMA’s challenge to Colorado’s use tax reporting requirements. This was an intermediary step in a much longer process, one that the MTC was involved in from the beginning. But in retrospect, the court’s ruling was also a turning point. It was this ruling that would be appealed to the U.S. Supreme Court. There, the DMA was in the position of having to argue that the Tenth Circuit was not barred by the TIA from considering the case because the requirement at issue was not the “collection” of a state tax. Colorado, with the assistance of its amici, including the MTC, argued that the TIA should apply regardless. When the Supreme Court ruled in the DMA’s favor, it effectively held that imposing a tax and imposing a reporting requirement were fundamentally different things. And when the case ultimately returned to the Tenth Circuit, this holding is what persuaded that court that Quill’s physical presence requirement was not applicable.

April 2016

On April 7, 2016, almost one year to the day after the MTC finished development of a plan to help states jointly address intercompany transactions, the Commission held the first meeting of its new Arm’s Length Adjustment Service committee. The initial plan created a detailed and sophisticated program of services for participating states — including the ability to combine their resources to make more efficient use of necessary, high-priced transfer-pricing experts. The program as designed didn’t attract enough state participation to launch as envisioned. But because the need remains great, the MTC decided, instead, to establish a committee to facilitate ongoing, joint state discussion on specific transfer pricing cases. The committee quickly renamed itself the State Intercompany Transactions Advisory Service committee to better describe both its promise and its focus.

August 2016

On August 29, 2016, the Direct Marketing Association filed its second petition to the U.S. Supreme Court in the litigation challenging Colorado’s use tax information reporting requirements. DMA had filed its first petition over a year before seeking reversal of the 10th Circuit ruling that the case could not be heard in federal court under the Tax Injunction Act. As noted in a prior segment, while the Supreme Court ruled for the DMA on that procedural issue, the Court’s decision actually helped Colorado convince the circuit court that the reporting requirements were neither discriminatory nor in violation of Quill. Nor would the DMA’s second petition, which challenged the holding as to discrimination, be the final petition filed in this litigation. In an unusual move, supported by the MTC, Colorado filed a conditional cross-petition to raise the issue that the DMA had avoided—whether Quill should be overturned. As the MTC argued in its amicus brief for Colorado, it was time to finally address Quill and this case provided as good a vehicle as any. But instead, the Court denied both petitions.

December 2016

At the end of December 2016, a long-awaited decision out of California’s Supreme Court held that the state legislature did not have to withdraw from the Multistate Tax Compact in order to amend the compact’s apportionment formula. But by then, California’s legislature, having anticipated a loss in the appellate court below, had already withdrawn, ending the state’s almost four-decades-long membership. A number of commentators predicted the MTC could not survive without California’s support. But, as Mark Twain famously remarked about mistaken reports of his own death, reports of the Commission’s demise were also “greatly exaggerated.” Nor has the so-called “compact litigation,” also known as the “Gillette litigation” because of the California case, turned out the way many predicted, thanks in part to the ability of the states and the Commission to jointly mount a skillful defense.