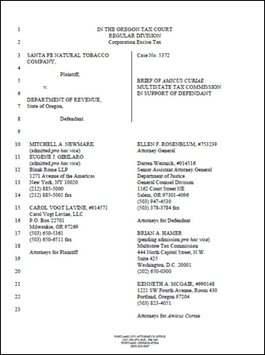

The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co. v. Dept. of Revenue. This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the seller’s P.L. 86-272 income tax immunity. The Commission’s brief, filed in support of the Oregon Department of Revenue, sets forth the legislative history of P.L. 86-272 and Congress’s narrow intent when enacting the statute. The brief also describes U.S. Supreme Court preemption jurisprudence, which provides that federal preemptions should be narrowly construed and that courts should not interpret federal statutes to preempt state taxing powers unless that is the clear and manifest purpose of Congress.

You can read the brief by clicking here .