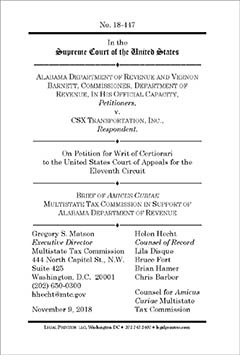

On November 9, 2018, the MTC filed an amicus brief in the United States Supreme Court supporting Alabama’s petition for writ of certiorari in Alabama v. CSX. The MTC encouraged the court to grant the petition in order to clarify its previous holdings in the case, which involves the question of whether rail carriers may be subjected to a fuel tax that is parallel but not identical to those imposed on motor and water carriers. CSX has argued that these taxes discriminate against rail carriers in violation of the 4-R act, 49 U.S.C. § 11501(b)(4). In its prior holdings in this case, the Court determined that the scope of the 4-R Act is extremely broad—encompassing all manner of taxes and tax issues and potentially diverse comparison classes that may give rise to claims of discrimination.

In its brief, the MTC noted that, while the Court has also said a claim of discrimination under the act may fail if it cannot identify one or more “substantially similar” comparison groups, or if the state shows that the differential treatment is sufficiently justified, those concepts do not appear grounded in any particular established principles. Speaking from an administrative perspective, the MTC asked the Court to grant certiorari and draw a more defined boundary for this federal preemption.

You can read the brief by clicking here .